Updates

Spice Up Your Weight Loss Journey With Global Flavors

Wondr Health is hosting an upcoming webinar called “Spice Up Your Weight Loss Journey With Global Flavors” on March 30th at 11:00 a.m. MT. The Wondr instructor and registered dietitian nutritionist, Meridan Zerner, will share simple ways to introduce flavors from cultures around the world into everyday meals.

Wondr Health is hosting an upcoming webinar called “Spice Up Your Weight Loss Journey With Global Flavors” on March 30th at 11:00 a.m. MT. The Wondr instructor and registered dietitian nutritionist, Meridan Zerner, will share simple ways to introduce flavors from cultures around the world into everyday meals.

You do not have to been enrolled in the Wondr program to participate in the webinar. Anyone and everyone is welcome to sign up! REGISTER HERE

This program is a great program to help give me the skills and encouragement to eat more nutritionally, get a lot more movement in throughout the day, sleep better, coping skills throughout, helped me really focus, and changed my mindset on my health. I may not have lost much weight but I went down 1 size, my blood pressure and blood sugar has really come down making me and my doctor very happy. ~ member testimonial

This program is a great program to help give me the skills and encouragement to eat more nutritionally, get a lot more movement in throughout the day, sleep better, coping skills throughout, helped me really focus, and changed my mindset on my health. I may not have lost much weight but I went down 1 size, my blood pressure and blood sugar has really come down making me and my doctor very happy. ~ member testimonial

Between July 1 and December 31, participants reported nearly 3,800 pounds lost as they logged their weight more than 24,000 times in the user-friendly app.

The program includes online courses, physical activity tracker, tailored content on behavioral eating, a team of counselors and a community of other Wondr Health participants. Best of all, the cost of the program is covered 100% for enrolled members regardless of which plan you have selected.

Want to get signed up for Wondr and take advantage of all the program has to offer? Check out the Wondr Health FAQ

At Home COVID-19 Testing at No Cost

Now more than ever it is important to take care of yourself and those around you. All health plans, including the State’s Group Insurance Program, are developing plans to combat COVID-19 as the Omicron variant has presented new challenges. Two new programs are now available to help you obtain at-home COVID-19 tests.

Order Free Tests Now:

Through a new program offered by the federal government, every home in the U.S. is eligible to receive 4 free at-home COVID-19 tests. The tests are completely free of charge and will be shipped through the United States Postal Service. You DO NOT have to be enrolled in the State’s health plan

Visit https://www.covidtests.gov/. Filling out the form takes less than 30 seconds. Order your tests now so you have them when you need them.

Get Reimbursed for Purchased Tests:

Individuals enrolled in the State’s health plan who purchase over-the-counter (OTC) rapid antigen tests will be able to seek reimbursement from their group health plans or health insurance. Purchases are limited to no more than 8 tests per enrolled member per calendar month.

Starting January 15, members covered under the State’s health plan who buy FDA-authorized rapid antigen tests will be able to submit a paper claim, with a receipt, for reimbursement to Blue Cross of Idaho. Tests can be purchased online, at a pharmacy or store.

Use this Member Claim Form: OTC COVID Test Reimbursement Form

These programs may change as the Public Health Emergency (PHE) is continually reevaluated and our carrier works on a network solution that would promote greater accessibility and convenience for members. All new information and updates will be shared as they become available.

Get Care at Your Pharmacy

The Office of Group Insurance and Blue Cross of Idaho are continuously looking for ways to remove barriers to care and make health care more convenient for members.

The Office of Group Insurance and Blue Cross of Idaho are continuously looking for ways to remove barriers to care and make health care more convenient for members.

With that goal in mind for 2022, we are excited to share that starting January 1 the state of Idaho health plan launched a pilot project with Idaho-based Albertsons and Safeway pharmacists to provide coverage for the diagnoses of certain issues, as well as prescribing and filling of certain prescription drugs.

What’s covered?

- Flu vaccine

- Rapid flu test

- Rapid strep test

- Urinary tract infection (UTI) diagnosis

- Cold sore diagnosis and treatment

- Hormonal contraceptives, and

- Statins

Several pharmacies currently offer similar services on a cash-pay basis, but this pilot project will make these services a covered benefit under the health plan at $0 copay for the PPO and Traditional members. High-deductible plan members have no cost sharing after you’ve met your deductible.

Keep in mind, coverage for this service is currently limited to Idaho-based Albertsons and Safeway pharmacists. Visit local.pharmacy.albertsons.com/ID to find an Idaho Albertsons or Safeway pharmacy near you.

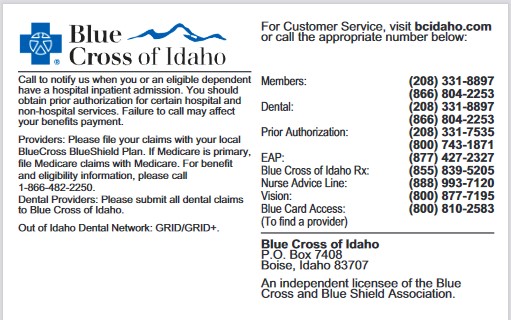

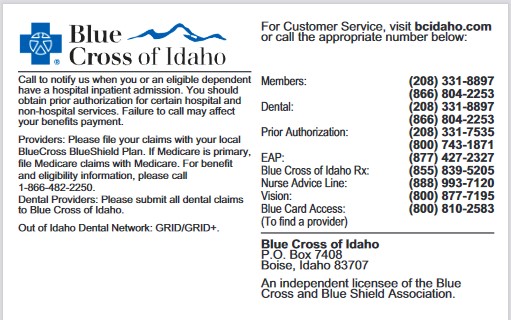

![]() Haven’t set up your Blue Cross of Idaho member portal account? Need to order more member ID cards? Need to see how much you’ve accumulated towards meeting your deductible? Have your Member ID card handy and visit members.bcidaho.com.

Haven’t set up your Blue Cross of Idaho member portal account? Need to order more member ID cards? Need to see how much you’ve accumulated towards meeting your deductible? Have your Member ID card handy and visit members.bcidaho.com.

Talk to a Nurse First at No Cost

With an increased awareness of illness and wellness during the past 18 months, it can seem overwhelming to triage your own symptoms, determine if they need medical attention, and select the appropriate site of care.

With an increased awareness of illness and wellness during the past 18 months, it can seem overwhelming to triage your own symptoms, determine if they need medical attention, and select the appropriate site of care.

The 24/7 Nurse Advice Line lets you talk with a registered nurse, at no cost to you, to help you make informed choices about your health or the health of any member of your household even if they are not covered under the plan. The Nurse Advice Line does is not a substitute for medical attention but is available to help you navigate your symptoms or concerns and options for addressing the situation.

You can also listen to a robust audio library of pre-recorded messages on a variety of healthcare topics.

![]() Program the Nurse Advice Line into your phone so you always have it handy: 888-993-7120.

Program the Nurse Advice Line into your phone so you always have it handy: 888-993-7120.

The Nurse Advice Line can also transfer you over to an MDLive provider if your issue is beyond their scope of service.

Haven’t set up your Blue Cross of Idaho member portal account? Have your Member ID card handy and visit members.bcidaho.com.

It’s not too late to get tobacco-free in 2021

How are those New Year’s resolutions going? Did you start the year on a mission to quit smoking or using other tobacco products but somewhere along the way you got sidetracked?

Well now is a great time to revisit those resolutions because nicotine cessation aids are covered at 100% under the preventive provisions of the State’s health plan!

Nicotine cessation products can be used to help members quit tobacco use. These include over the counter quit aids like patches, gum and lozenges and tobacco cessation drugs that can be prescribed by a doctor. Details about this benefit can be found in each plan document posted on the Medical page.

Health Benefits of Quitting

Lowered risk of lung cancer and many other types of cancer.

Reduced risk for disease and early death. While the health benefits are greater for people who stop at earlier ages, there are benefits at any age. You are never too old to quit.

Reduced risk of heart disease, stroke and peripheral vascular disease (narrowing of the blood vessels in outside your heart).

Source: cdc.gov/tobacco/data_statistics/fact_sheets/cessation/quitting

Members enrolled in the State’s health plan can also access a 12-week tobacco cessation workshop in the WellConnected section of the Blue Cross of Idaho member portal, https://members.bcidaho.com. Or call the customer service number on the back of your member ID card for more information about programs and quit aids.

![]() Haven’t set up your Blue Cross of Idaho member portal account? Have your Member ID card handy and visit members.bcidaho.com.

Haven’t set up your Blue Cross of Idaho member portal account? Have your Member ID card handy and visit members.bcidaho.com.

No Better Time To Be Healthy

Chronic health conditions often happen for a number of reasons that are beyond our control. These conditions can put a strain on your overall well being, your family, and your finances. The State’s health plan has programs in place to help members manage and even improve their chronic conditions, navigate the healthcare system, and provide support to their loved ones.

You can learn about available resources on the Be Healthy page of the OGI website that include programs like:

- Condition Support (formerly known as Disease Management) empowers members and caregivers, in collaboration with their physicians and care providers, to effectively manage disease and prevent complications through adherence to medication regimens, regular monitoring of applicable lab/vital signs, a healthy diet, exercise, and other lifestyle choices. The program offers support to members and dependents who are managing an acute or complex illness or are at risk for or have a chronic condition such as:

- diabetes,

- asthma,

- chronic obstructive pulmonary disease (COPD),

- coronary artery disease, or

- heart failure.

- Care Management (formerly known as Case Management) can help you better understand your conditions, teach you how to take an active role in your healthcare and help with navigating any obstacles you run into. Through this program, members work directly with a care manager who will create a personalized care plan. You get education materials and resource support.

![]()

![]()

![]()

![]()

Do you have a primary care provider (PCP)?

Having a regular doctor – also called primary care provider or PCP – not only helps you get healthy but stay healthy. A PCP helps you navigate all of your healthcare needs, from big to small. They will review your medical records and medications, discuss your personal medical history as well as your family members’, and conduct general exams. Follow-up visits can be centered on specific healthcare goals such as strategies to improve or manage wellness or to treat an illness. Need more extensive care than your PCP provides? A PCP can also help coordinate care with specialists as well.

Where and when to get care [PDF]Here are a few ways to find in-network care:

- Log in to the Blue Cross of Idaho member app and select Find Care.

- Visit members.bcidaho.com and log in to your member account. Select Search Tools, then select Find a Provider. There, you can search and find a list of providers in your network.

- Call Blue Cross at the number on the back of your member ID card for help locating a provider.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

The Office of Group Insurance and Blue Cross of Idaho have provided a variety of ways for you to access your information for those circumstances where you need it most.

You may also contact the Office of Group Insurance by phone, email or through the website with questions about the benefits administered by our office.

Understanding Your Life & Disability Insurance

Life can be unpredictable and it’s important to be prepared so that you know your loved ones are taken care of in the event something happens to you. These can be difficult conversations for some people, but you have resources and support to navigate the process.

To help you better understand each benefit, we’ve created brief summary documents for each:

- Basic Life Insurance provides a death benefit equal to 100% of your annual salary for the employee, a $10,000 spouse benefit and a $5,000 child benefit.

- Short-Term Disability (STD) is used when an employee is temporarily disabled and can’t work for a short amount of time, this benefit is used to replace a portion of the employee’s income. Examples of qualifying conditions include recovery after surgery and mental health condition.

- Long-Term Disability (LTD) generally begins after short-term disability benefits end. Examples of qualifying conditions include cancer and accidental injuries.

- Voluntary Term Life (VTL) may be purchased at 1x, 2x, or 3x your annual salary worth of coverage (maximum of $500,000) as well as additional spouse and child coverages available. VTL premiums are paid entirely by the employee. If you enroll more than 31 days after your initial date of hire, you will be required to provide Proof of Good Health for yourself and any dependents you add to this coverage.

You should keep a copy of all life insurance paperwork in a safe place at home, with your accountant, or a trusted family member. Your HR office will also have a copy of your beneficiary designation forms in your personnel file.

As a participant in the state’s Basic Life policy, you have access to Will & Legal Document Services at no charge. You and your spouse can create, print and store essential legal documents – such as a will, living will, healthcare power of attorney, durable power of attorney, and medical treatment authorization for minors. Plus, you can access estate planning tools and a personal information organizer. Check out the Principal Discounts & Extras on the Be Healthy page of the OGI website.

![]()

![]()

Virtual Care 24/7 With MDLive

![]()

![]()

![]()

![]()

MDLive provides quick and convenient virtual medical and behavioral services. If you are enrolled in the State’s medical plan all MDLive copays and coinsurance have been waived this plan year regardless of the health plan you selected at enrollment.

Don’t have a medical need right now? Why not download the app on your Apple or Android device and activate your MDLive account so that when you do have a need to see a provider for one of the 50+ available routine services? It will be as easy as opening the app and connecting.

MDLIVE Welcome [PDF]

MDLive is also ready to listen and support you and your family during challenging times. Their board-certified psychiatrists and licensed therapists can help you process the information as it develops, create strategies to manage your concerns, identify healthy activities, and put together a plan tailored to your unique situation and needs.

Now, more than ever, is a great time to focus on what you can control and your overall well-being. Schedule a private, confidential visit and keep both mentally and physically healthy with MDLive.

![]()

![]()

Mental Health – The Other Annual Checkup

Everyone deals with tough times, but even happy events like a new job, a marriage, or a new baby can add stress. That is when taking an hour for a session, or two, or three, with a counselor might help you navigate new or persistent challenges in your life and increase your overall well-being.

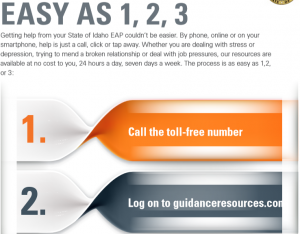

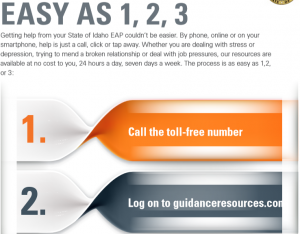

The State’s Group Insurance Program provides an Employee Assistance Program (EAP) to all benefit eligible employees and their dependents regardless of their enrollment in any other program. The provision for this benefit is detailed in each of the medical plan contracts posted on the Medical page of the OGI website.

There are several ways to access the GuidanceResources(R) information and programs.

![]()

![]()

![]()

![]()

Official Government Website

Official Government Website