Updates

Livongo for Diabetes Management

We’re excited to roll out Livongo, a new medical benefit at no additional cost to you. Livongo combines advanced technology and one-on-one coaching to engage members and improve diabetes management. Livongo, a part of Teledoc Health, Inc., will provide this service to all eligible members on the State’s health plan starting July 1, 2021.

What is Livongo:

- Livongo is a digital health platform that empowers people with chronic conditions to live better and healthier lives.

- For participants, Livongo delivers actionable, personalized and timely feedback when and where you need it most to help change and improve behaviors.

Here’s what you get when you join:

- Advanced technology. Get a new blood glucose meter and unlimited strips and lancets. Depending on your health goals, you could also receive a smart scale and/or blood pressure monitor. Track your progress and manage your health in the Livongo app.

- Better health monitoring. Livongo’s connected devices automatically upload your readings right to your app. You’ll also get personalized tips to support you on your health journey.

- Expert support when you need it. Expert health coaches are ready to help, on your terms. Get tips on managing your blood sugar, healthy eating, weight, blood pressure and more.

To enroll in Livongo for Diabetes, you must have a diagnosis of type 1 or type 2 diabetes.

To enroll in Livongo for Diabetes, you must have a diagnosis of type 1 or type 2 diabetes.

Now Even More Reasons to Smile

Plan history has shown that at least 40% of state employees enrolled in the dental plan aren’t visiting a provider even once a year. Imagine the time and pain of costly dental and/or medical issues that could have been averted if those issues had been caught early on or prevented altogether.

In an effort to minimize any barriers to care for members, you can now smile a little brighter because as of July 1, 2021 all preventive dental services are covered at 100% for in-network PPO and Traditional dental providers. Preventive dental services include exams, cleanings, X-rays, and fluoride for eligible dependents.

![]() Don’t have a regular dentist to get your cleanings every six months? Maximize your benefits by using the searchable provider feature on the Blue Cross of Idaho Member Portal to locate a PPO network dentist.

Don’t have a regular dentist to get your cleanings every six months? Maximize your benefits by using the searchable provider feature on the Blue Cross of Idaho Member Portal to locate a PPO network dentist.

Do you know how often you should visit the dentist or how long you should brush your teeth? It’s easy to remember with the 2-2-2 rule! Brush and floss 2 times a day for 2 minutes and visit the dentist 2 times a year. This rule applies to kids and adults alike.

Most people know that good oral and dental hygiene can help prevent bad breath, tooth decay and gum disease – and can help you keep your teeth as you get older. But, a healthy mouth can also ward off medical disorders. An unhealthy mouth, especially if you have gum disease, may increase your risk of serious health problems such as heart attack, stroke, poorly controlled diabetes and preterm labor.

![]()

![]()

![]()

![]()

![]()

![]()

Cavities are preventable. Model good oral health habits for your whole family.

New Healthy Living Resources

The State’s health plan has not included a true lifestyle and weight management program in several years. So we are thrilled to roll out Wondr Health (formerly Naturally Slim) to all of our adult members. What we like about Wondr Health is that it isn’t a diet. It is a long-term investment in your nutrition and lifestyle education that results in weight loss and better overall health. Who can’t use that skill?

How do you get signed up? Check out the Wondr Health FAQ

For more about health promoting programs available to you, visit the Be Healthy page of the OGI website or visit the Blue Cross of Idaho member portal, https://members.bcidaho.com.

Haven’t set up your Blue Cross of Idaho member portal account? Have your Member ID handy and visit members.bcidaho.com.

Preparing your health & wallet for the new plan year

The new plan year starts July 1! You can expect to start receiving frequent communications from Blue Cross of Idaho, Navia (if you signed up for Flexible Spending), Office of Group Insurance and your HR office highlighting new and continuing programs and benefits. All communications are intended to promote your “Benefits IQ” and show you how to put your premium dollars to good use.

Check out the FY22 New Plan Year Highlights that includes information about:

- New weight management program

- New diabetes management program

- Enhanced dental coverage

- New ER copay

- Continuing benefits you already have access to

- And more…

Keep in mind that if your insurance needs or personal situations change throughout the year, there are mid-year actions you can take to adjust your benefit elections. See the chart below for a very high level overview of acceptable changes. More detailed information can be found throughout the Office of Group Insurance website: https://ogi.idaho.gov

| When can I make changes? | Is this change limited to Open Enrollment? | |

| Medical | You can add/drop coverage for yourself and your dependents at any time during year. | No (exceptions for dependent dental) |

| Dental | You can drop dependent coverage at any time. | Adding previously declined dependent dental is limited to Open Enrollment EXCEPT when you are adding a newly eligible dependent to coverage; in this case previously declined dependents may enroll under a “tag along” provision. |

| Health Care FSA | You can increase/reduce your contributions after a qualifying life event. | Yes, unless you have a qualifying life event. To continue FSA, you must re-enroll every year during open enrollment. |

| Day Care FSA | You can enroll/increase/reduce your contributions after a qualifying life event. | Yes, unless you have a qualifying life event. To continue FSA, you must re-enroll every year during open enrollment. |

| Basic Life | You can change your beneficiaries at any time. | No |

| Voluntary Term Life (VTL) | You can enroll/increase/decrease your coverage any time. However, outside a life event you will be required to submit proof of insurability to be approved for coverage. | No |

![]()

![]()

![]()

![]()

![]()

Keep an eye on the Office of Group Insurance website, https://ogi.idaho.gov, for information in the Stay Informed blog, well-being resources in the Get Healthy page, information to navigate Life Events, and more…

You can always ask your agency’s HR office for information about enrolling in the medical and dental benefits if you are not currently enrolled or if you would like to add/delete dependents.

Questions? Contact the Office of Group Insurance in person, by telephone or email.

The Value of Flexible Spending Accounts (FSA)

Now is the time to enroll for Flexible Spending Accounts (FSA) to begin participation July 1, 2021. Here is information to help you determine if an FSA is right for you. Open Enrollment ends May 14!

A Flexible Spending Account (FSA) is a program that allows benefit eligible employees to pay for eligible medical, dental, vision care, and/or dependent care expenses with pre-tax dollars through payroll deduction. You select a per pay period contribution amount, up to a specified maximum. The money deposited into these accounts is not taxed at the time of contribution, and remains tax-free when it is withdrawn as reimbursement for eligible expenses. If an employee wishes to take advantage of a FSA each year, they must renew the account during the open enrollment period.

Employees can enroll in either or both of the Health Care Flexible Spending Account (HCFSA) and/or Day Care Flexible Spending Account (DCFSA). Dollars deposited in these accounts are kept separate and cannot be transferred from one account to the other. Both accounts are administered by Navia Benefits Solutions and if the participating employee registers on the Navia website or mobile app they can track the activity of their account online.

Benefit eligible employees DO NOT have to be enrolled in the State’s health plan to participate in the FSA.

In addition to eligible medical, dental and vision expenses, the Health Care Flexible Spending Accounts (HCFSA) are now allowed to reimburse items such as:

- Over-the-counter (OTC) drugs or medicines, without a prescription, such as aspirin, antihistamines, cough syrup, etc.

- Menstrual care products.

- Personal protective equipment (PPE) like hand sanitizer and face masks.

- More approved items available for purchase on the FSA Store on the Navia member portal!

![]()

![]()

Day Care Flexible Spending Accounts (DCFSA) reimburse you for childcare expenses for children up to age 12. New for the coming plan year, the DCFSA annual maximum was increased to $7,746 (household max).

![]()

![]()

For more information about how flexible spending accounts work, annual maximums, use-it-or-lose-it provisions, qualifying events to enroll or change mid-year, and other tips, visit the OGI Flexible Spending webpage.

If you are interested in participating, ask your HR office how to access your FSA enrollment before May 14.

Virtual Care 24/7 with Nurse Advice Line & MDLive

![]()

![]()

The Nurse Advice Line can also transfer you over to an MDLive provider if your issue is beyond their scope of service.

MDLive is ready to listen and support you and your family with medical and behavioral health providers ready to video chat with you 24/7. Now, more than ever, is a great time to focus on what you can control and your overall well-being.

Their board-certified psychiatrists and licensed therapists can help you process the information as it develops, create strategies to manage your concerns, identify healthy activities, and put together a plan tailored to your unique situation and needs.Schedule a private, confidential visit and keep both mentally and physically healthy with MDLive.

If you are enrolled in the State’s medical plan all MDLive copays and coinsurance have been waived through the end of the plan year.

MDLIVE Welcome [PDF]

Prevention: the act of stopping something from happening

Remember the old saying that “an ounce of prevention is worth a pound of cure”? This particularly rings true when it comes to preventive health care. Maintaining or improving your health is important – and a focus on regular preventive care, along with following the advice of your doctor, can help you stay healthy.

Did you know that there is no cost to enrolled members for listed preventive, screening and immunization services if you use an In-Network provider?

![]()

![]()

Details about those preventive services that are covered by your medical plan at 100% and other services subject to co-pays and cost-sharing are available on the ‘Medical’ tab of the Office of Group Insurance website. Select and view the Summary of Benefits and Coverage (SBC) or plan contract for the plan type in which you are enrolled. You can also call customer service at the number on the back of your ID card for assistance.

Take advantage of this great benefit and schedule a preventive health care visit with your doctor today!

![]()

![]()

The Office of Group Insurance is committed to providing employees with details about the benefits available through the group insurance program. Visit the OGI website, https://ogi.idaho.gov, for resources and links to helpful benefit information.

Start 2021 with a smile!

Most people know that good oral and dental hygiene can help prevent bad breath, tooth decay and gum disease – and can help you keep your teeth as you get older. But, a healthy mouth can also ward off medical disorders. An unhealthy mouth, especially if you have gum disease, may increase your risk of serious health problems such as heart attack, stroke, poorly controlled diabetes and preterm labor.

Plan history has shown that at least 40% of members enrolled in the dental plan aren’t visiting a provider even once a year. Imagine the time and pain of costly dental and/or medical issues that could have been caught early on or prevented altogether.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Cavities are preventable. Model good oral healthcare habits for your whole family.

Protect your identity in 2020

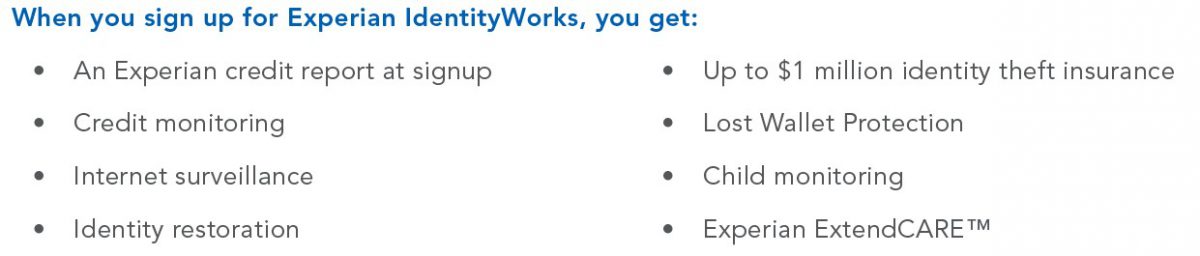

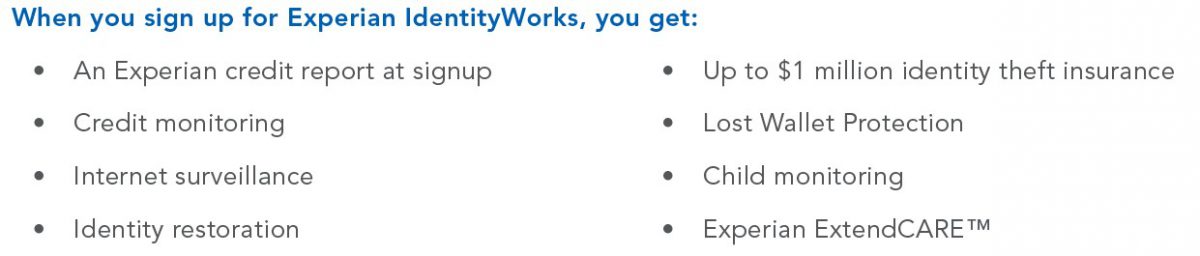

In today’s high-tech world, it’s critical to keep a vigilant watch on your personal and financial data. The State of Idaho and Blue Cross of Idaho are helping to assist members with that effort.

It’s important to protect what’s most valuable to you, especially your health, family and home. This is an added layer of protection.

Members enrolled in the health plan should visit the Blue Cross of Idaho member portal and look for the Experian logo at the bottom of the homepage once you are logged in.

Haven’t set up your Blue Cross of Idaho member portal account? Have your Member ID handy and visit members.bcidaho.com. In addition to finding the link to enroll in the IdentityWorks services, the member portal also allows you to view plan information, explanation of benefits (EOB) documents, search for network providers and so much more.

Questions? Contact the Office of Group Insurance in person, by telephone or email.

The First Wealth is Health

Ralph Waldo Emerson is attributed with saying “The First Wealth is Health.”

While no one would choose to have a chronic health condition, they do happen for a number of reasons. The State’s health plan has programs in place to help employees and their families manage and even improve their chronic conditions which also helps them manage their costs for healthcare related expenses.

![]()

![]()

Members also have access to the Blue Cross Disease Management Program whose goal is to empower members and/or caregivers, in concert with their physicians and other care providers, to effectively manage disease and prevent complications through adherence to medication regimens, regular monitoring of applicable labs/vital signs, a healthy diet, exercise, and other lifestyle choices. The program offers support to members and dependents who are managing an acute or complex illness or are at risk for or have a chronic condition such as:

- diabetes,

- asthma,

- chronic obstructive pulmonary disease (COPD),

- coronary artery disease, or

- heart failure.

Type 2 diabetes makes up the majority of all diagnosed cases of diabetes. The good news is that you can take simple steps to lower your risks with a healthy diet, regular exercise, not smoking and keeping your blood pressure in check.

![]()

![]()

![]()

Official Government Website

Official Government Website